About Visitor Copywriter

Once a major accident, you happen to be seeking to repair much more implies than simply one. You will want operations, actual therapy or other high priced medical treatments. You can have to take faraway from functions. Because you other individuals, your own expenses may be turning up and you will preventing you against which have the new intellectual crack you need.

An injury lawsuit is often the most practical method to recoup economic compensation to own crashes caused by carelessness. Such circumstances provide extra capital one to insurance firms can't or won't spend. The challenge that have an injury allege, although not, would be the fact a settlement or trial may take months otherwise years to get accomplished. Because you await justice becoming offered, your money might take a change for the worse.

Just like the title ways, these are money supplied to compensation for injuries plaintiffs while they waiting to own a settlement otherwise decision. In some cases, a personal loan may be the best bet if you prefer more money to blow your own expense while you loose time waiting for a settlement check. not, while this form of capital can easily personal loan rate of interest simplicity your bank account worries, such finance aren't for everyone.

This article will help you know about the huge benefits and you will downsides away from suit fund and help you will be making the choice that's top to you personally.

PRO: You don't have to spend a lawsuit financing right back for many who eliminate your own injury instance.

The zero-exposure facet of case loan is probably the extremely appealing feature. Occasionally the absolute most guaranteeing claims is also falter when the a legal or jury discovers need not to ever signal in your favor. Because you may not be punished for folks who treat your instance, this is often a powerful cause to determine case loan in place of an unsecured loan. A consumer loan lender will need repayment even though you lose the situation.

CON: Rates try brutal having lawsuit financing.

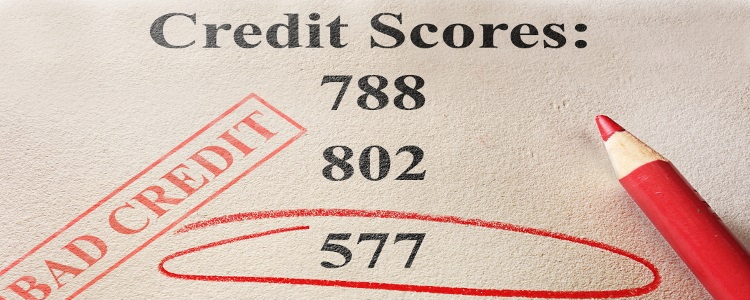

Rates of interest is actually a fear of any loan. Of several lawsuit financing, not, has interest levels one to edging into astronomical. With rates of interest anywhere between twenty-seven% so you're able to sixty%, the borrowed funds many years honor. In comparison, an unsecured loan is much more likely to features rates of interest ranging of 5% so you can thirty six% based your credit score.

If you do ultimately love to apply for case financing, make sure to lookup and this credit businesses offer the lower costs – that way more of their payment resides in the wallet.

PRO: You should buy case mortgage even after a poor credit score.

Suit funds may be the friendliest money option to you aren't a keen mediocre or reasonable credit score. Of many lenders often decide away from examining your credit score whenever deciding in the event that they'll render to you case mortgage. Banking institutions or other personal bank loan loan providers, additionally, almost always check your credit score, thus case mortgage may be the sole option available to those with a detrimental or non-existent credit history.

CON: For those who have a poor case, it can be difficult to get case mortgage.

Pre-settlement lenders are usually simply willing to financing money to help you readers that good personal injury cases. In order for the lender to get their cash back the plaintiff need to profit their circumstances, therefore, the bank tend to completely read the the brand new legal aspects of one's situation. When you have a sizeable percentage of fault or if perhaps proof is forgotten, you have got difficulty acquiring a lawsuit loan.

Your own personal burns lawyer will be leave you a fair investigations from the case's probability of triumph, nevertheless the lender's research might be more strict.

PRO: Case financing can prevent you against taking lower than your need.

Often, paying down your own circumstances is the best action to take. Various other conditions, a great plaintiff may feel pressured to simply accept a settlement because the money gets rigid. A lawsuit loan offers more of a cushion to try and you may wait until the latest defendant offers an amount that is reasonable or the situation minds in order to demo.

CON: It could be difficult to pick case bank.

Lawsuit money don't have the exact same governmental regulations one to most other money, such mortgages, located. This is why, loan providers have completely different policies and you may must shop around to obtain a lender towards finest history and you can payment standards.

Fortunately you actually have some help on the research. The higher Company Agency has actually reviews of some lenders and your county will also have used guidelines to assist control the fresh suit loan business.

If you decide to realize case mortgage, pose a question to your attorney to appear along the price and make sure nothing is unlawful otherwise leaves you inside the an unfair situation. Certain attorney can certainly be able to discuss their interest, so be sure to use your lawyer because the a source.

PRO: Case mortgage can give you comfort.

This history advantage to pre-settlement fund may seem random, but it is maybe not. There is absolutely no doubt that case financing has its own cons. It age, therefore the technique to see a lender is generally arduous.

It doesn't matter, when you have lingering worry worrying all about your own medical expenses otherwise you just do not have the fund to live a single day-to-go out lifestyle, then choice to apply for that loan is straightforward. Your overall health and you may well-are should not suffer since you wait for the results of your own injury lawsuit.

You will need to do your homework and you will speak to your attorney, however, case financing can be the best option to keep your bank account.